Murphy gets two-week delay for proposing next NJ state budget

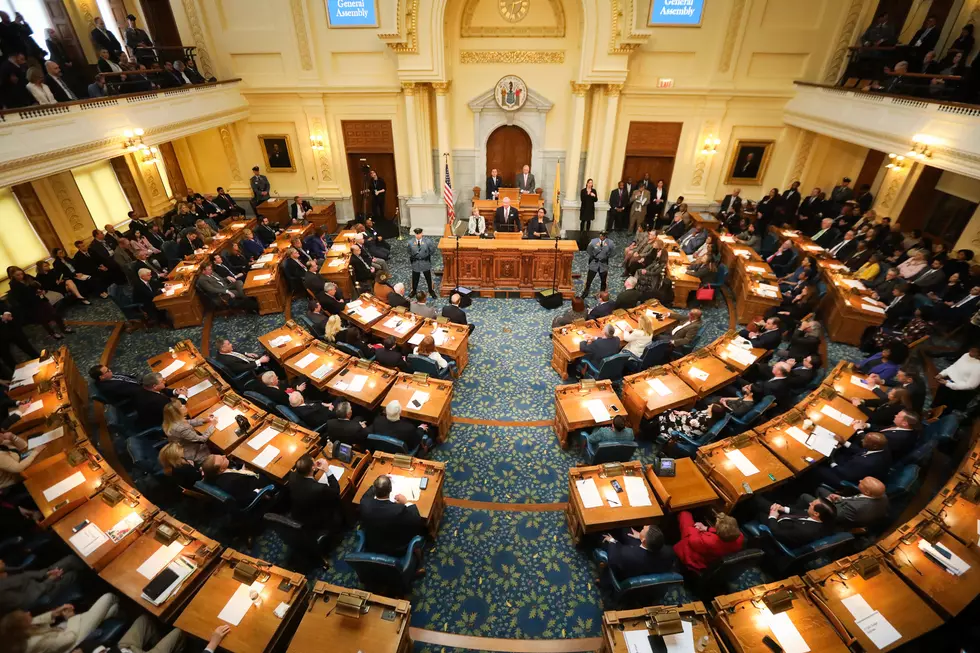

TRENTON – Lawmakers granted Gov. Phil Murphy’s request to delay his speech introducing the proposed state budget for fiscal 2023 by two weeks, from Feb. 22 to March 8.

State law directs that the budget proposal is to be unveiled on the fourth Tuesday in February. It’s not unheard of for it to be delayed, but that’s more typically done when a new administration takes office or a recession is causing a financial crunch and difficult decisions.

That’s not the case now, as Murphy just won re-election and revenues through the first seven months of the fiscal year are $4 billion ahead of their pace from one year earlier.

The vote on A2063/S1414 was mostly along partisan lines, with Democrats in favor and Republicans opposed. The Senate passed it 23-11, and the Assembly passed it 43-32 with one vote to abstain.

Sen. Vince Polistina, R-Atlantic, and Sen. Jean Stainfield, R-Burlington, were the only Republicans to vote for the bill. Assemblyman Ron Dancer, R-Ocean, voted to abstain.

Republicans said the delay was requested due to politics, not because of pandemic science or government finance. They said Murphy wants to wait until after the statewide school mask mandate ends March 6 and to stall before addressing what to do with the state’s apparent windfall, which Sen. Declan O’Scanlon, R-Monmouth, estimates will be more than $3 billion.

“That’s $3 billion that we have the opportunity and should take as quickly as possible to give it back to taxpayers,” O’Scanlon said. “That’s about $1,000 per household. Why would we delay the start of this deliberation? Why would we narrow the period of time where we could take action to give this money back?”

“This is being done strictly for political reasons and not science,” said Assemblyman Hal Wirths, R-Sussex. “The focus groups are the cause of this meeting being moved.”

“The administration even leaked to the New York Times that they had conducted focus groups post-election, which leads us to believe that this is all political,” said Assemblywoman Nancy Munoz, R-Union. “Pushing the budget address back has nothing to do with science, it’s political science.”

Assemblyman Brian Bergen, R-Morris, said the Legislature should hold Murphy accountable for delivering a budget on schedule and in time to allow for a full review process.

“Every time this legislative body comes to a crossroads, where you can choose between transparency, good government, open public input, lengthy discussion and debate with the intent of getting to the best possible solution the first time, or opaqueness, backroom deals and a rushed legislative process, you always make the wrong choice, and our people pay every single time,” Bergen said.

Democrats said there was no harm in a two-week extension and that it won’t hurt the budget review.

“We’ll close those two weeks. Even if we have to spend extra time down here, we’ll close those two weeks,” said Sen. Paul Sarlo, D-Bergen, the Senate budget committee chair. “… I don’t want anybody to walk out of this chamber today thinking that we’re not going to do our due diligence. We’re going to spend the necessary time over the coming weeks to dive into this budget.”

Assemblywoman Eliana Pintor Marin, D-Essex, the chairwoman of the Assembly Budget Committee, said governors of both parties have been granted extensions to introduce a budget.

“Especially when we’re continuing to have strong revenues, it will give us a better opportunity to have better numbers when we do start our budget process,” Pintor Marin said.

Lawmakers acknowledged that one side effect of the delay is that schools will have to wait an extra two weeks to be told by the Department of Education how much aid they can expect for next school year.

The state Treasury Department announce Monday that January tax collections were 15% higher than last January, topping $4.7 billion. Over the first seven months of fiscal 2022, revenues are more than $4 billion ahead of the same period a year earlier, up almost 22%.

The state said income tax collections – up 17% so far this fiscal year – are expected to slow noticeably in the spring due to new or expanded tax credits, such as the state’s new pass-through business alternative income tax, or PT-BAIT, approved to provide help to taxpayers hurt by the federal cap on state and local tax deductions.

Michael Symons is State House bureau chief for New Jersey 101.5. Contact him at michael.symons@townsquaremedia.com.

The Ultimate Guide to New Jersey Brewpubs

BEEP BEEP BEEP: These are the 13 types of Wireless Emergency Alerts auto-pushed to your phone

More From New Jersey 101.5 FM