With economy teetering, will NJ budget still seek millionaires tax?

Gov. Phil Murphy hasn’t yet said what changes will be made in the overhauled 2021 state budget, though he has indicated a few times that he’d still like it to include an increase in the millionaires tax.

Murphy said last week that raising taxes on income over $1 million, which he is proposing for a third straight year, makes even more sense with state revenues in turmoil due to the fallout of the novel coronavirus business shutdowns.

“I think what we’re going through screams out to me at least that reliable, recurring revenue is the most important revenue you can have, that you know will consistently be there,” Murphy said. “And our revenues are getting crushed right now, not surprisingly.”

The federal stimulus bill enacted last Friday includes $3.44 billion for New Jersey state and local governments to address the pandemic, though that won’t come close to covering the increases in spending and decreases in tax collections that will result.

“It’s not the last amount of support we’re going to need,” Murphy said. “But I think taxes, like the millionaire’s tax at a minimum become more relevant as opposed to less relevant.”

In all, Murphy’s 2021 budget plan included around $1.2 billion in tax increases, headlined by the approximately $495 million that would be generated by the millionaires tax.

Assemblyman Hal Wirths, R-Sussex, said the millionaires tax should be shelved.

“Take that off the table. I think it’s more unlikely now, but we shouldn’t be talking about any kind of tax increases at all during this crisis,” said Wirths, the Republican budget officer. “I guarantee you, you have way less millionaires than you had when this was floated.”

“I just would urge the governor and the Democrats who control both houses to come out and say, hey, tax increases, toll increases, cigarette tax – everything’s off the table until we get to a stable economy again,” he said.

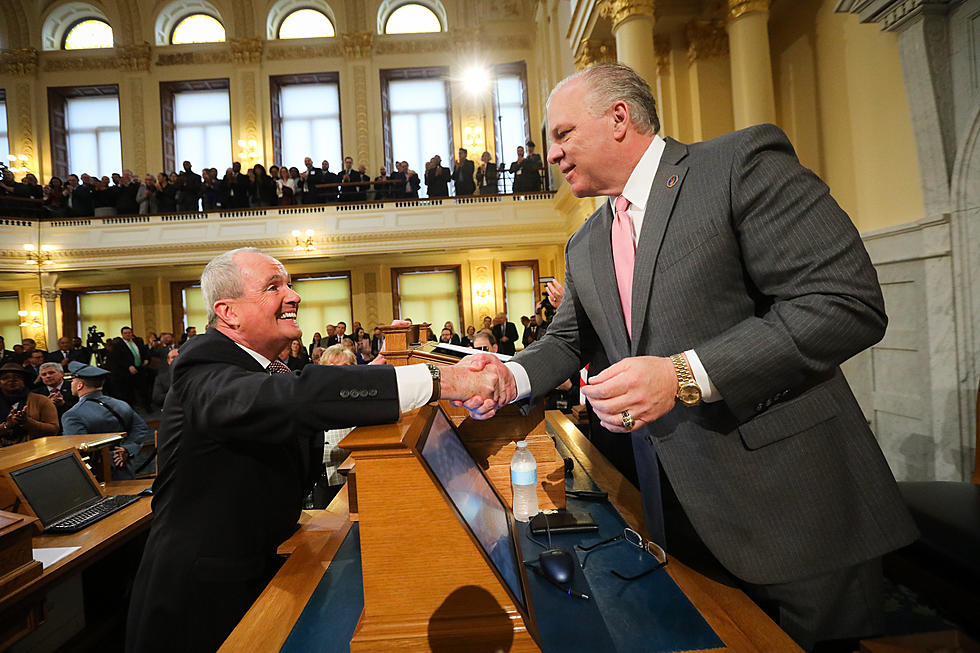

Senate President Steve Sweeney, D-Gloucester, has raised the idea of temporary tax holidays in an effort to boost the economy, but any such plans are still conceptual. Sweeney had said when Murphy introduced the budget Feb. 25 that he didn’t support the tax increase proposals.

Wirths said the state needs stability, not uncertainty about tax hikes.

“The federal government’s doing everything possible to put money in people’s pockets,” Wirths said. “I just think that the state should at least pledge not to increase any taxes during this crisis or next year’s budget. I think that’s the least we can do as elected officials.”

Murphy said he hopes to provide an update soon about the budget and specifically about delaying the tax filing deadline, which is in two weeks. The federal deadline was extended to July 15. A bill now on Murphy’s desk would extend New Jersey’s deadline to June 30.

“We had a good conversation late (Tuesday) morning with our teams, with the Senate president and the speaker,” Murphy said. “We are as soon as we can looking to come to folks with guidance about where the budget is headed.”

Scenes from coronavirus testing in NJ

Michael Symons is State House bureau chief for New Jersey 101.5. Contact him at michael.symons@townsquaremedia.com.

More From New Jersey 101.5 FM