NJ considers suing IRS after feds block state’s income tax scheme

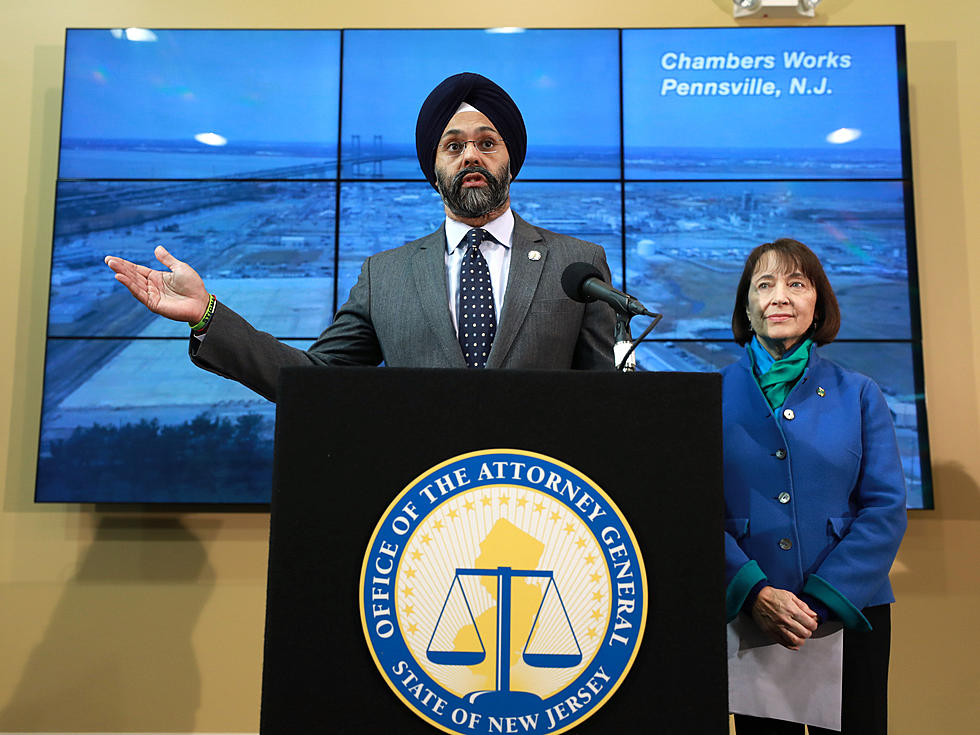

TRENTON — State Attorney General Gurbir Grewal said he would consider legal action against the IRS over the Treasury Department decision that blocks a potential workaround to the cap on state and local tax deductions.

The Treasury Department issued final rules Tuesday that would clamp down on taxpayers trying to circumvent a new cap on state and local tax deductions.

The Tax Cut and Jobs Act, promoted by the Trump administration and passed in late 2017, limits the amount of state and local taxes that can be deducted on an individual's federal taxes to $10,000 a year. The tax law's rules on SALT deductions, as they are known, caused a lot of upset in high-tax states, such as New York, New Jersey and California, where residents had previously benefited from being able to deduct much more.

It also became a highly politicized issue as many of high-tax states tend to vote for Democrats.

Some states, including New Jersey, tried to find workarounds. This included states allowing taxpayers to donate to charity funds and, in exchange, receive tax credits against their state or local taxes. Taxpayers could then deduct their donations as charitable contributions on federal taxes, lessening their broader tax burden.

But under the new regulations, taxpayers would only be able to deduct charitable contributions greater than the amount of the tax credit they received. For example, if a taxpayer donates $1,000 to a state program and receives a 70% credit, they could only claim $300 — not the $700 they may have been aiming for.

Grewal in a statement called it "bad law and bad policy" for the IRS to undermine state charitable programs.

“I was proud to lead a coalition of Attorneys General opposing the IRS’s proposal, and I remain as committed as ever to challenging the IRS in court for going through with its harmful and illegal approach," Grewal said.

“The IRS today made clear it is not interested in fairness for New Jersey’s taxpayers," Gov. Phil Murphy said in a statement. "Instead, it protects President Trump’s politicization of the federal tax code. Finalizing a rule that prohibits us from following decades of precedent to protect our residents’ tax deductions is a gut-punch to middle-class families who know that the Trump tax plan is a complete sham. We will continue to fight alongside our Congressional delegation and sister states to restore our residents’ full SALT deductions."

There are some exceptions for dollar-for-dollar state tax deductions and for tax credits in which a taxpayer gets a credit worth less than 15% of their donation.

The Treasury Department said that the regulation is "based on a longstanding principle of tax law" that if a taxpayer receives a valuable benefit in return for a donation, they can only deduct the net value of the donation.

The final regulations take effect Aug. 11 this year but apply to contributions made after Aug. 27, 2018.

The regulations are "neither new nor surprising in clarity and direction" said Mark Steber, chief tax officer at Jackson Hewitt Tax Services.

He said the Treasury Department has been very clear from the get-go that any "creative interpretations or constructs intended to bypass the limitation" would be met with a negative response and potentially harsh consequences. While there have been many creative and alternative ideas for bypassing the limitation, Steber said they "all have been denounced by the most optimistic of tax experts."

Morris County Republican Assemblyman Joe Pennacchio said that the Democrats are "wasting taxpayer time and resources on a workaround that never had any chance of succeeding" and said the key to cutting property taxes in New Jersey is passing fiscal reforms to get the state budget on track.

“Many have stated that New Jersey was hit especially hard by the SALT cap repeal, but our property tax crisis is years in the making,” Pennacchio added. “I hope that we can work together on a bipartisan basis to develop real solutions, instead of fighting with the federal government and giving our hardworking families false options and false hope. Let’s get to work and cut high taxes now.”

Material from the Associated Press was included in this report.

Contact reporter Dan Alexander at Dan.Alexander@townsquaremedia.com or via Twitter @DanAlexanderNJ

More from New Jersey 101.5

More From New Jersey 101.5 FM