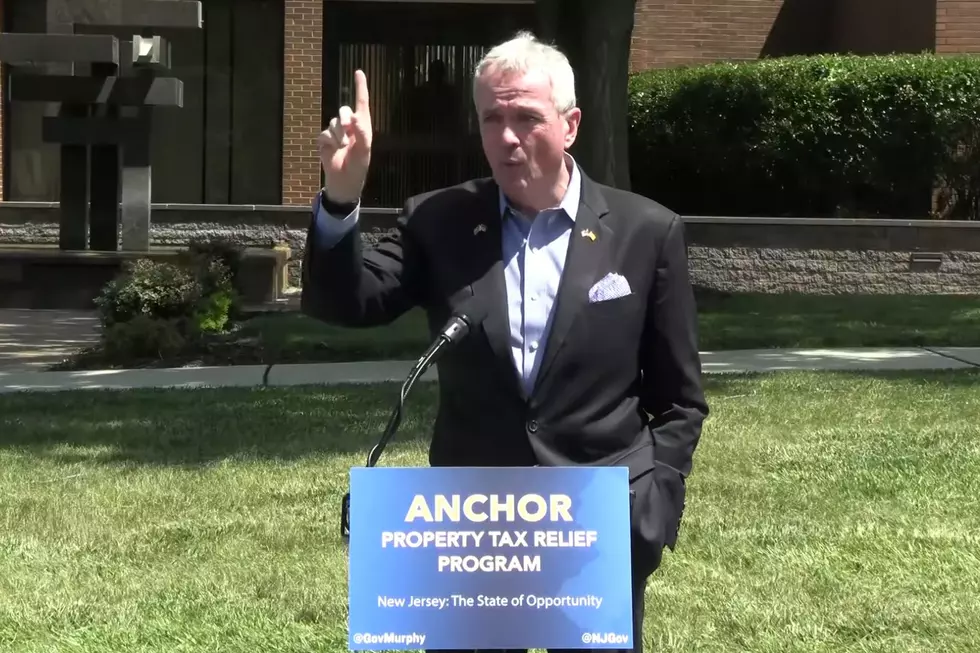

First up in new affordability focus: NJ municipal property taxes

TRENTON – Attempting to show the message from voters in the November election was received, the first state Senate committee meeting of the new legislative session focused on ways to ease the bite from property taxes.

The bills endorsed by the Senate Community and Urban Affairs Committee include ones that would restore around $331 million in state aid to towns, give renters a bigger property tax deduction and provide more relief to people behind on their mortgages during the pandemic.

“Many of us who saw the outcome of this most recent election understand quite honestly the pain that many of our fellow residents are facing with the affordability issues in our state,” said Sen. Troy Singleton, D-Burlington.

“Let us be clear that we need to drive for a more affordable New Jersey – at the same time, strive for a New Jersey that is also equitable, to make sure that everyone has an opportunity to live and achieve their own version of their American Dream in our state,” he said.

The restoration of aid to municipalities would increase distributions from the Energy Tax Receipts Property Tax Relief Fund, which utilities pay instead of a property tax on the rights-of-way that they use.

It used to be paid directly to local governments, but to make it simpler for the companies the state began collecting the revenue. The state, however, kept increasing amounts of that money for itself – around $14 billion since 2008, said Lori Buckelew, assistant executive director and director of government affairs for the New Jersey State League of Municipalities.

“As a result, municipalities have cut or eliminated services, raised fees, raised property taxes or a combination thereof to address the shortfall,” Buckelew said.

Under the bill, the diversion to the state budget would end gradually, with 20% of the funds restored each year from fiscal 2023 to 2027. It comes with a condition – that all that money be used to reduce property taxes by requiring municipalities to subtract any additional aid amounts from their tax levies.

Municipal taxes statewide exceed $9.2 billion, not including nearly $324 million more levied by special taxing districts performing municipal functions such as fire departments, economic development and garbage collection.

They account for nearly 30% of the $9,284 statewide average property tax bill, averaging $2,725. But they can vary significantly – from under $1,000 in 53 rural towns plus Camden, to over $5,000 in 20 affluent suburbs plus cities such as East Orange, Irvington, Union City, Elizabeth and Plainfield.

The tax deduction bill would benefit renters by allowing them to deduct 30% of their rent from their income tax bill as property taxes paid, rather the current 18%.

Sheila Reynertson, senior policy analyst for New Jersey Policy Perspective, said the proposal would be even more helpful if the deduction was made into a tax credit for people with low-paying jobs.

“And more importantly that the tax itself be refundable so that all renters, regardless of taxes owed, can benefit from the income tax reform,” she said.

Singleton said a newly proposed Senate bill would raise the gross income tax credit for homestead property taxes paid from $50 to $200, addressing the issue Reynertson raised.

The other endorsed bill provides mortgage payment relief for some residential property owners and small landlords during the pandemic.

The municipal aid, tax deduction and mortgage payment relief bills are not ready for votes in the full Senate, as each were referred to the Senate Budget and Appropriations Committee for a hearing there.

One bill that was on the committee’s agenda was not taken up. That bill – which has been pending without a hearing since 2004, reintroduced every session – would eliminate a supplemental tax on real estate sales enacted in 2003.

Michael Symons is State House bureau chief for New Jersey 101.5. Contact him at michael.symons@townsquaremedia.com.

2021 NJ property taxes: See how your town compares

Your photos: First blizzard of 2022 in New Jersey

More From New Jersey 101.5 FM