Should NJ drivers cross the NY border to buy gas?

While New Jersey's government has done nothing to offer drivers a break as gas prices head toward $5 a gallon, New York State is kicking off it's Gas Tax Holiday.

As part of the state budget, New York is suspending a 16-cent gas tax from June 1 through the end of the year.

Is it worth it to drive across the border to fill-up? Maybe.

It certainly wont make gas any cheaper if you try to fill up in Manhattan, where the average price is already $5.40 a gallon. You'll want to avoid Staten Island and Long Island as well, where average prices are around $5 per gallon.

However, if you take the Garden State Parkway or Route 287 across our state's northern border into Rockland County, NY, you might find a bargain.

A little farther North, and you can cross into Orange County, NY, where gas prices could drop below $4.75 a gallon.

However, when you factor in how much gas it takes to get there and back, your actual savings could be miniscule.

There is, however, a bit of cross border jealously when you consider how much New Jersey drivers could save if we followed New York's lead.

Sen. Shirley Turner, D-Mercer, sponsors legislation that would give drivers a 60-day gas tax holiday in New Jersey. Her proposal would drop the state's gas tax 27.9-cents from 42.4-cents to 14.5-cents.

If Turner's legislation was signed into law, it would drop our current gas prices below $4.50 per gallon.

Gov. Phil Murphy does not support the legislation, and says any gas tax holiday should come from the federal government.

Of the multiple proposals being floated by lawmakers for gas price relief, Murphy has expressed public support for only one.

Sen. Edward Durr, R-Gloucester, would provide residents direct rebates of between $250 and $500.

Murphy called Durr's proposal "worthy of debate" when he was asked about it in March.

None of the current proposals have be scheduled for action in the Senate or Assembly.

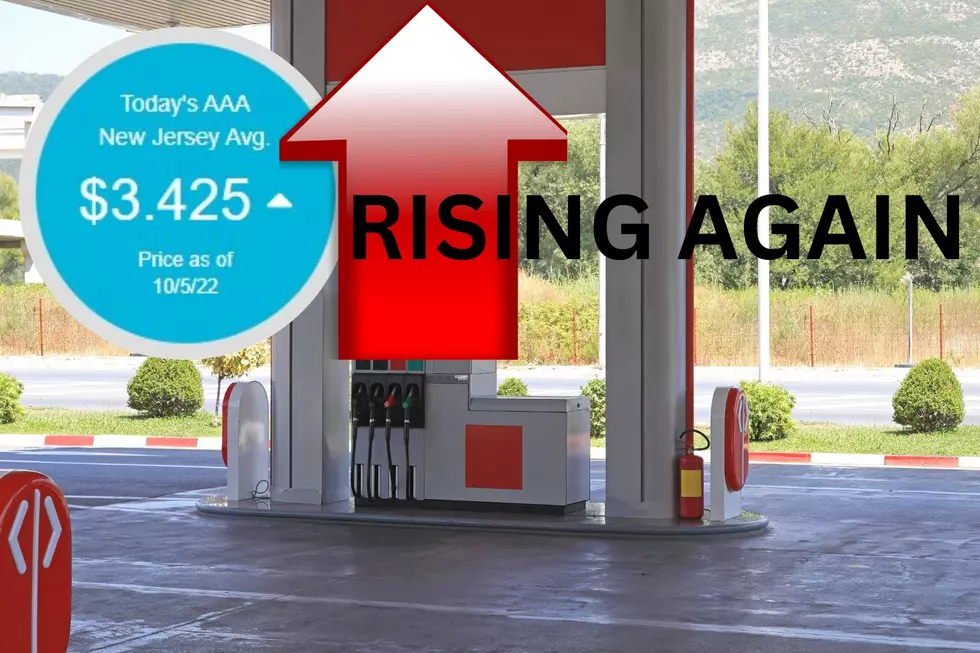

On Wednesday, AAA reported the average price for gas in New Jersey was $4.77 for a gallon of regular. That matches the record high set May 20.

Eric Scott is the senior political director and anchor for New Jersey 101.5. You can reach him at eric.scott@townsquaremedia.com

Click here to contact an editor about feedback or a correction for this story.

Every NJ city and town's municipal tax bill, ranked

School aid for all New Jersey districts for 2022-23

New Jersey's license plate designs through the years

More From New Jersey 101.5 FM