Democrats backed these tax incentives — but Murphy just vetoed them

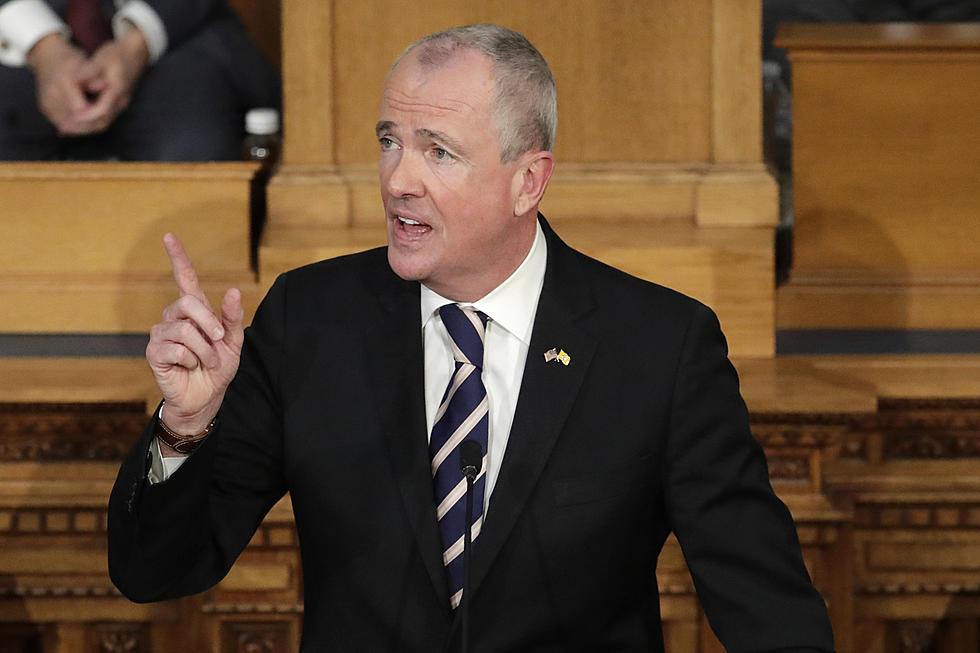

TRENTON — Gov. Phil Murphy has vetoed an extension of two tax incentive programs that are the subject of a state investigation.

Murphy's conditional veto on Friday returns the bill to the Legislature with recommended changes.

An auditor report and a comptroller review have raised questions over how the Economic Development Authority was running the tax incentive programs and whether businesses getting awards were meeting certain requirements.

Some businesses were found to have exaggerated their intentions to leave the state in order to earn tax credits.

The conditional veto contains recommendations to give tax credits to companies engaged in high-growth industries, U.S. businesses creating a Northeast headquarters and foreign businesses creating a U.S. headquarters.

It also recommends programs to reward companies that remediate brownfields and revitalize income-producing historic buildings.

The investigation into the tax incentives have been at the center of a feud between the progressive governor and George Norcross III, the unelected but influential leader of Democrats in South Jersey.

Some of the businesses that benefited from the tax breaks had ties to Camden-based Norcross.

Camden County Freeholder Director Cappelli, Jr. criticized Murphy's conditional veto on Friday by saying that it "leaves all of New Jersey in a weakened and uncompetitive position.

"With a new legislative session just months away, the governor has all but guaranteed that our state will not have an incentive program of any kind until well into 2020. In the meantime, struggling cities will have fewer tools to lure businesses and jobs to benefit their residents and their economy," Cappelli said. "Make no mistake, this will hurt the residents of those struggling cities and inner ring suburbs far more than anyone in his office.”

More From New Jersey 101.5 FM