NJ governor promises major new tax to fund NJ Transit

💲Gov. Phil Murphy is proposing a corporate transit fee to fund NJ Transit

💲The governor got a dig in at NYC's congestion pricing plan

💲Business groups said more is needed to help NJ Transit financially

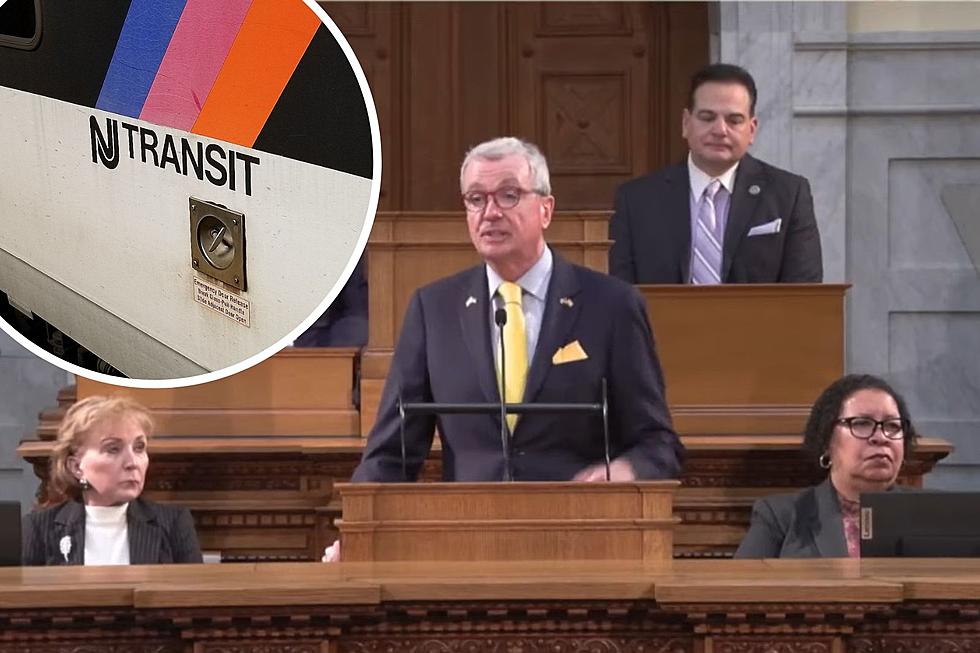

Gov. Phil Murphy is proposing a transit tax that would become the first dedicated revenue source for NJ Transit.

During his budget address Tuesday at the Statehouse, the Democrat proposed a 2.5% Corporate Transit Fee on corporations with more than $10 million in annual profit.

If approved, it would generate as much as a billion dollars for NJ Transit.

RELATED: All the goodies promised in Murphy's new budget

"Up to this point, our first priority has been solving NJ Transit’s operational challenges. Today, thanks to the progress we have made together, it is time to address our next priority: solving NJ Transit's fiscal challenges," the governor said in his speech.

Murphy also said he is working with NJ Transit CEO/President Kevin Corbett to make "meaningfully lower administrative costs while continuing to improve service."

Dig at NYC congestion tax

Murphy took a dig at New York City's congestion pricing plan, which the state has filed a lawsuit against to stop.

"Unlike some states that demand that their neighbors solve their transit troubles, we are solving our challenges on our own. We are building a public transit system that is faster, more equitable, and more reliable," Murphy said.

READ MORE: Murphy's staggering spending spree

NJ Transit will begin public hearings in March about a proposed systemwide 15% fare hike. The agency is currently faced with a budget deficit that will reach close to a billion dollars by fiscal year 2026.

More help for NJ Transit

New Jersey Business & Industry Association President and CEO Michele Siekerka said that it was just two weeks ago that Murphy said he was not having second thoughts about allowing the Corporate Business Tax surtax to expire.

“Yet, just days later, we are here with another new and unnecessary corporate business tax of a different name, returning New Jersey to its extreme outlier status for business taxes after seven weeks – retroactive to Jan. 1, to add insult to injury," Siekerka said.

She said that Pennsylvania is lowering its top CBT rate to 4.9% and funding its transportation system without using corporate taxes.

New Jersey Policy Perspective analyst Alex Ambrose called the tax a "big deal" for transit riders and the state as a whole as it provides NJ Transit "strong dedicated funding" and protects its future. But Ambrose cautioned the tax doesn't solve all of NJ Transit's problems.

"We can’t forget that riders are staring down a potential double-digit fare hike, and the agency is still raiding its capital budget, so there’s a strong argument for bringing back the full corporate surcharge to spare commuters from shouldering that burden," Ambrose said in a statement.

Report a correction 👈 | 👉 Contact our newsroom

2024 Seaside Heights Polar Bear Plunge raises $2.75M

Gallery Credit: Andrew Miller/For New Jersey 101.5

New Jersey's St. Patrick's Day Parades 2024 (by date)

Gallery Credit: Dan Alexander

Biggest NJ company layoff notices in 2022 and 2023

Gallery Credit: Erin Vogt

More From New Jersey 101.5 FM