Gas tax relief? Sorta kinda. How about a tax deduction?

After the New Jersey Legislature passed a measure at the end of last week to increase the gas tax by 23 cents a gallon one lawmaker is looking for a way to soften the blow.

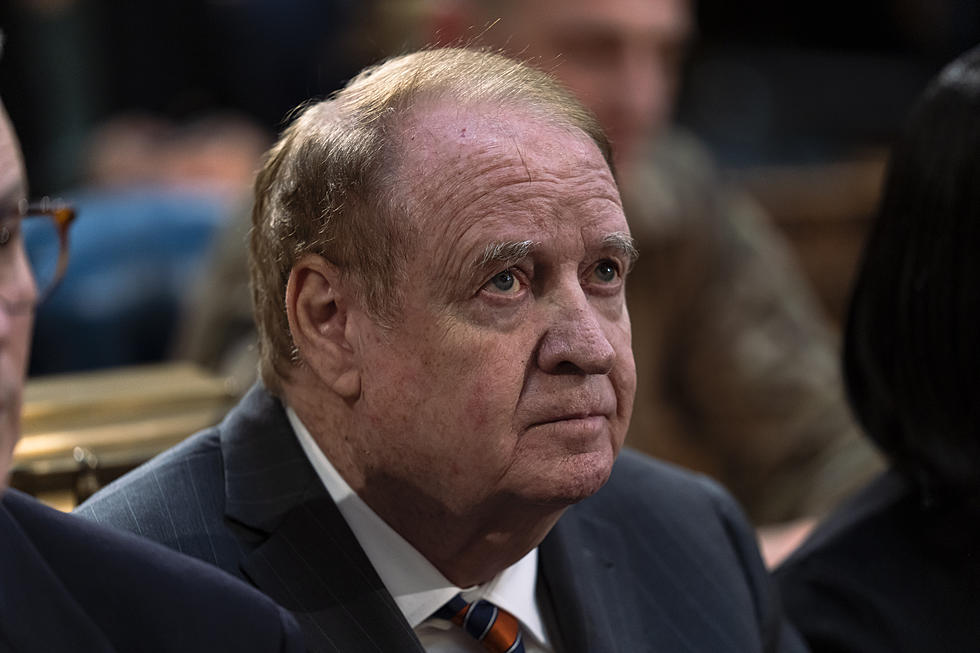

Assemblyman John Burzichelli (D-Burlington) said under his proposed measure “you’ll keep track of all your (gas) purchases through the year. When you file your income tax you would declare how much tax you had paid at the pump and whatever deduction is available, you would be entitled to.”

The legislation stipulates taxpayers making less than $100,000, including married couples filing jointly, married persons filing separately and individuals would be allowed to deduct all of the taxes paid on motor fuel.

The maximum deduction would be capped at $500 for the current taxable year and $1,000 after that moving forward.

Burzichelli said we do need to raise revenue to fix our roads and bridges, which means people are going to be paying more than they’re presently paying, so the idea is “to try and take the edge off. People are not happy about 23 cents because it comes as sticker shock. To many it’s alarming.”

He described the bill as a work in progress, and stressed “we’ve got to see what the math is. What the governor has proposed and the measure that’s been passed talks about other tax relief, and we have to see what the budget will bear. It may be appropriate that some of that tax if not all of it should be deductible off of the personal income tax. This may be a viable option."

Burzichelli pointed out it’s been over a quarter of a century since the gas tax has been raised, and said it probably should have been raised a little each year, instead of hitting motorists with a 23-cent-a-gallon increase — but that’s not what happened.

“There’s no doubt money has to be raised to fix roads and maintain bridges in a safe way, but at the same time this burden will have an impact on people, and if there is a way to bring relief to that impact we should be striving to do that,” he said.

Assemblyman Troy Singleton, along with Burzichelli, is co-sponsoring the measure.

The gas tax increase legislation approved by lawmakers includes the elimination of the estate tax by January 2018 and the gradual elimination, over four years, of taxes on retirement income, such as pensions, for retirees with incomes under $100,000. It also includes a tax deduction for veterans and an increase in the earned income tax credit.

More from New Jersey 101.5:

More From New Jersey 101.5 FM