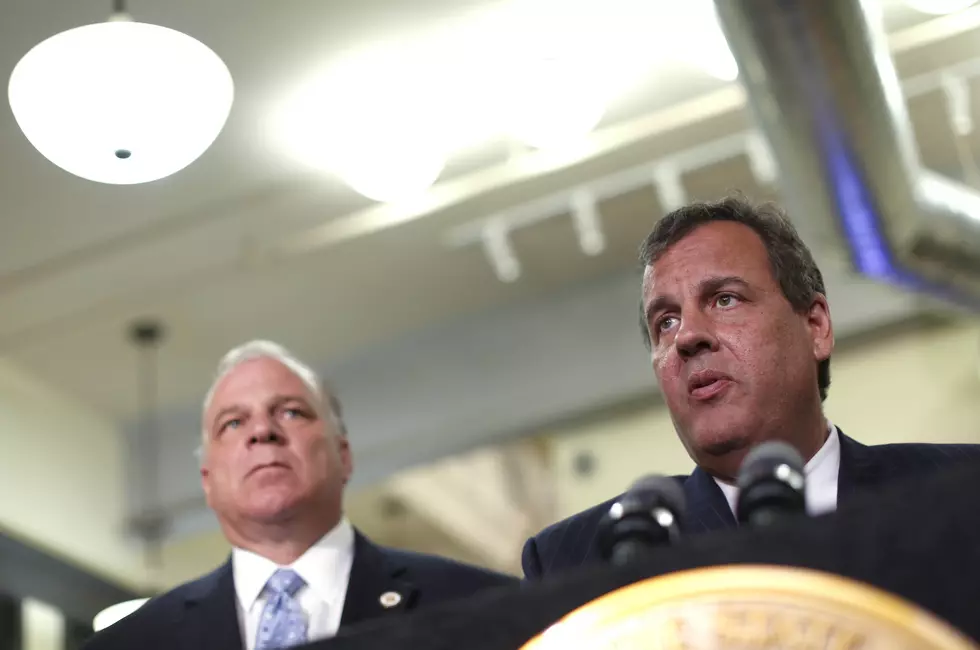

![Novel Idea for NJ: How About a Tax Cut? [AUDIO]](http://townsquare.media/site/385/files/2014/03/56044816.jpg?w=980&q=75)

Novel Idea for NJ: How About a Tax Cut? [AUDIO]

With talk coming out of Trenton in recent weeks about some top Democrats who want to discuss hiking the gas and millionaires' taxes, one legislator actually wants to lower a tax we all pay -- but history shows the possibility of success is not high.

"My bill would lower the state sales tax from 7 percent to 6 percent," said state Sen. Jennifer Beck (R-Red Bank). "We all understand that New Jersey is an overtaxed population and talk of new taxes is rightfully frightening to people."

The state sales tax was increased to 7 percent under former Gov. Jon Corzine in 2006 after a week-long state government shutdown, as Democrats waged an intra-party battle. In 2007, Beck introduced her sales tax reduction bill for the first time and has been reintroducing it every year, since including this year.

"Rolling it back from seven to six is a billion dollars in lost revenue, so that might not be tenable in the current economic situation," Beck said. "Certainly we should take a look at what is covered under the sales tax and consider withdrawing some items and services."

The first items and services Beck would like to take a look at are those that were newly applicable after the 2006 tax increase. The senator cites tanning salons, digital ringtones, dry cleaning, limousine services and magazines as just a few examples.

"We already know our population is very overtaxed, and we've got to roll some of them (the taxes) back if we're going to be competitive in the future," Beck said.

More From New Jersey 101.5 FM

![NJ Treasurer Explains Tax Cut Benefits [AUDIO]](http://townsquare.media/site/385/files/2012/01/MoneyStack2.jpg?w=980&q=75)

![Helping NJ Residents in Flood Zones [AUDIO]](http://townsquare.media/site/385/files/2014/01/1702901141.jpg?w=980&q=75)

![Is a Gas Tax Hike in NJ’s Future? [AUDIO]](http://townsquare.media/site/385/files/2012/07/GasPump.jpg?w=980&q=75)