Tax trade-off proposed to solve transportation funding problem

The top two Democrats in the State Legislature say reducing taxes on retirees, inheritances and estates in exchange for an unspecified tax increase to replenish the nearly bankrupt Transportation Trust Fund is part of the ongoing negotiations with Gov. Chris Christie.

The inheritance and estate taxes are known as death taxes, and New Jersey is one of only two states that has both.

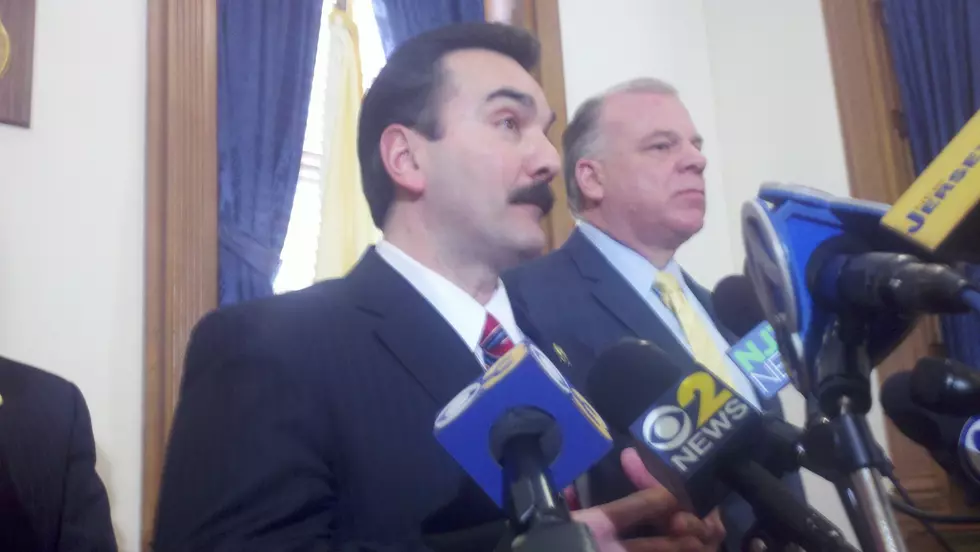

"Those have been in the discussion to be honest with you. I think we definitely need to work on this and I think this is something that has been in a robust conversation," said Assembly Speaker Vinnie Prieto (D-Secaucus) on Thursday. "All these are moving parts. It's complicated."

Eliminating the estate tax alone would cut state revenue by approximately $440 million, which would have a serious impact in the next fiscal year's budget, Prieto said. He also said another idea in the mix involves restoring a tax credit for the working poor who would be overburdened by an increase in the gas tax.

"The estate tax is horrible. The inheritance tax is horrible (and) we're one of the few states that taxes retirement income," said State Senate President Steve Sweeney (D-West Deptford). "We're more than willing to look at some trade-offs because we do need to start pulling these things back."

Dating back to 1892, the transfer inheritance tax is one of New Jersey's oldest taxes. The 16 percent tax is applied when property is transferred outside the immediate family. Another so-called "death tax," known as the estate tax, is applied on property valued at more than $675,000. New Jersey Business and Industry Association president Michele Siekerka said New Jersey is one of 21 states with either kind of death tax.

"We are advocating right now for an issue around the dual death taxes and we have said candidly we don't want it to be an offset to any other tax. We should be addressing it in and of itself," Siekerka said, adding she was happy to learn repealing or cutting the taxes is being discussed.

One existing proposal would completely repeal the transfer inheritance tax and amend the estate tax to increase the filing threshold to $5.1 million. The only other state to impose both of the so-called death taxes is Maryland.

More From New Jersey 101.5 FM