![Property Tax Appeal Calendar in NJ Would Move Under Bill [AUDIO]](http://townsquare.media/site/385/files/2014/03/RS2397_126989085.jpg?w=980&q=75)

Property Tax Appeal Calendar in NJ Would Move Under Bill [AUDIO]

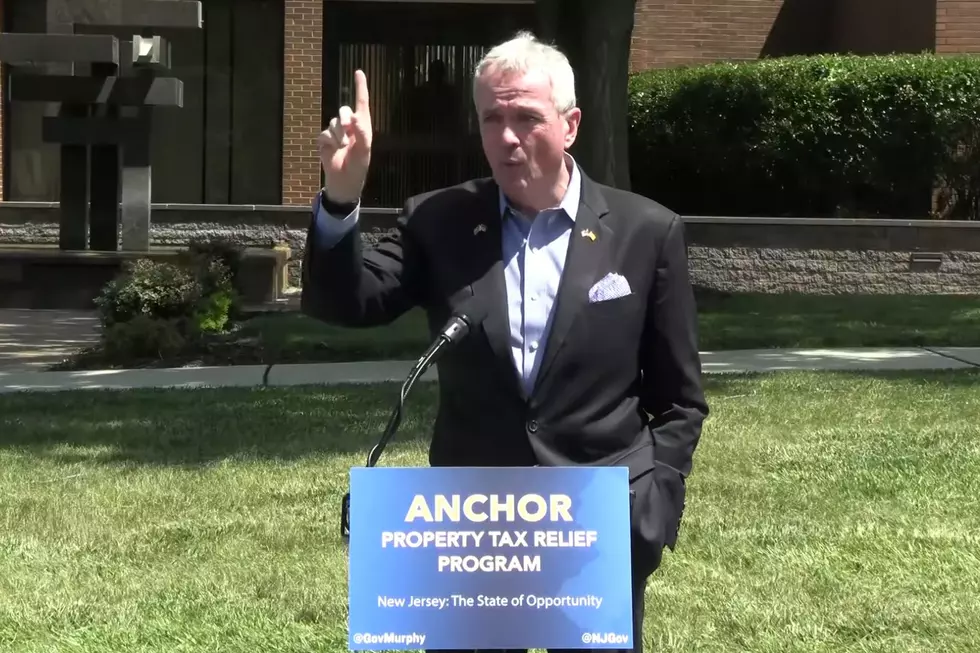

New Jersey's property tax assessment appeal process would see some changes statewide under new legislation.

Currently, many property tax assessment appeals aren't resolved until after local budgets have been set, leaving municipalities to scramble to find money to pay back a successful property tax appeal.

Legislation recently introduced by Assemblyman Vince Mazzeo (D-Northfield) would reschedule the tax appeal process statewide to dates before the adoption of a local budget.

"Our goal is to adopt a more pragmatic time frame for tax appeals in order to reduce costs for municipalities and ultimately save taxpayers their hard earned money," Mazzeo said in an emailed press release May 29.

Mazzeo said it's difficult for towns to anticipate revenue losses to property tax appeal wins, and towns are often left having to use their surplus or borrow money to pay for them.

By adopting a new statewide time frame, towns will be able to create a more accurate local property tax rate, according to Mazzeo.

"You get to anticipate exactly what you're going to lose as far as tax appeals and then you get to anticipate perhaps tax revenues that you might lose. It'll be a way to find a more organized fashion as far as anticipating revenue losses," Mazzeo said.

Under current state law, appeals are heard by the county tax board and decided in most cases by the end of July after municipal budgets are adopted. Mazzeo said this puts a huge burden on towns which have to refund to excess property taxes if a property owner wins an appeal. He said it can also place a burden on taxpayers if they have to pay a refund.

More From New Jersey 101.5 FM