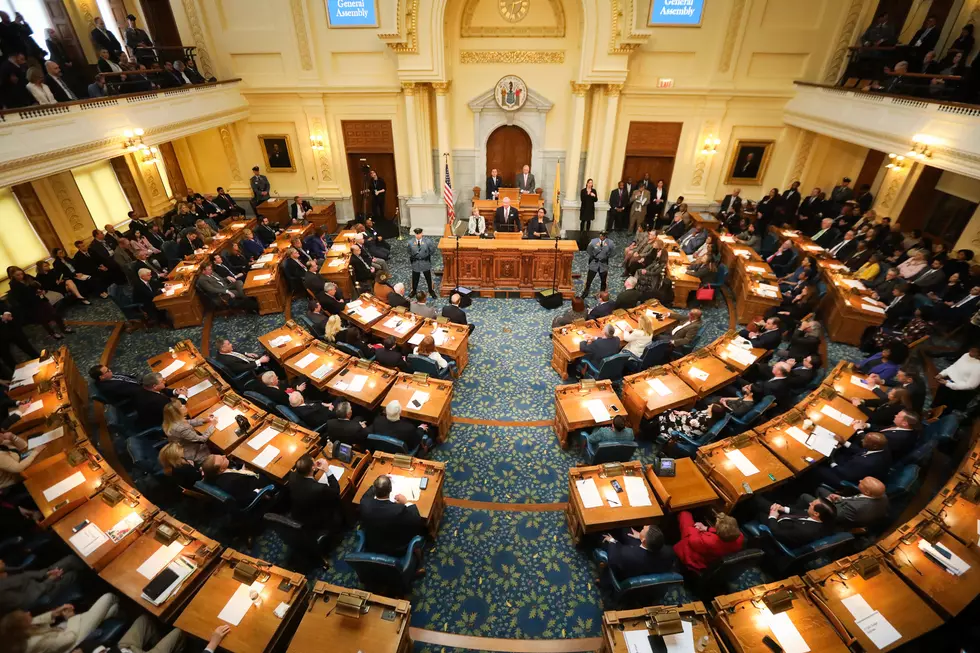

![NJ Treasurer Nixes Millionaire’s Tax Hike [POLL/AUDIO]](http://townsquare.media/site/385/files/2014/03/RS2397_126989085.jpg?w=980&q=75)

NJ Treasurer Nixes Millionaire’s Tax Hike [POLL/AUDIO]

Despite needing to plug a nearly $807 million budget gap before June 30, a hike in New Jersey's millionaire's tax is not likely to happen as a method for producing new revenue according to state treasurer Andrew Sidamon-Eristoff.

"I think raising rates at the highest marginal level would be disastrous for the state's competitive position and ultimately its fiscal position over the medium and long-term," Sidamon-Eristoff said.

The super wealthy in New Jersey are already paying a large percentage of the state's total gross income tax receipts according to the treasurer.

"Just 50 taxpayers pay almost five percent of our gross income tax," Sidamon-Eristoff explained. "We simply can't continue to expect sustainable revenues with a top heavy system such as we have today."

Budget balancing areas that are under consideration include payments for Medicaid services, school aid, tuition assistance, health benefits for teachers and state employees, the state retirement system and more.

Generating revenue by enacted a tax amnesty period for delinquent filers is something the treasurer also opposes.

"Everything is on the table, but I am personally opposed to the idea of a tax amnesty and I will make every effort and every argument I can against it," Sidamon-Eristoff said.

More From New Jersey 101.5 FM