NJ Public Pension Cash Protections Advance

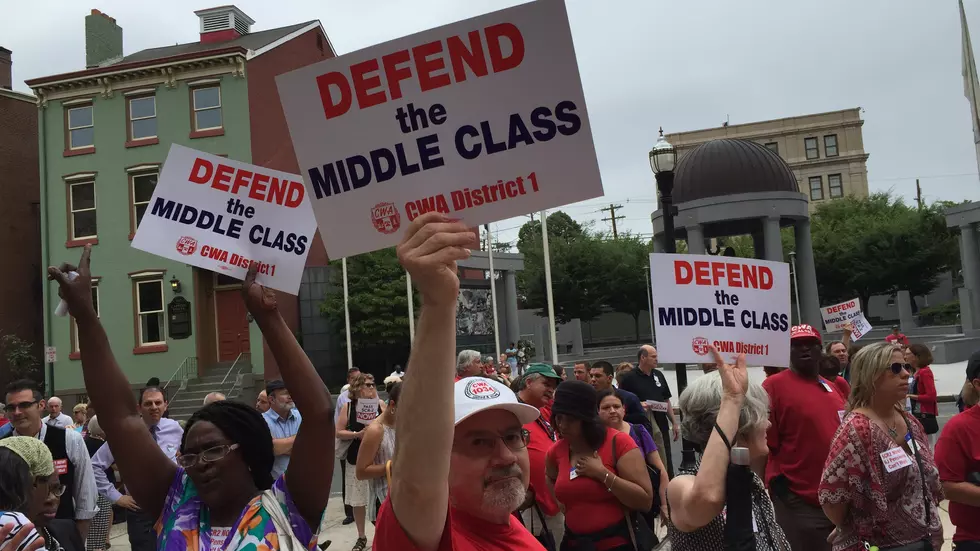

A three bill package aimed at enforcing safeguards against excessive investing and pay-to-play for investments made with public pension funds was released this morning by an Assembly Panel. Assembly Democrats Ralph Caputo and Ruben Ramos sponsor the package.

The first bill would limit political contributions by hedge funds and private equity funds that invest in casinos. Under the measure, the hedge fund would be subjected to same limitations on making political contributions as would the applicants for, or holders of a casino license. The bill also prohibits public funds from being invested in any hedge fund or equity fund that has made political contributions that would make a business entity ineligible to enter into a contract with the state pursuant to the pay-to-play law.

“New Jersey must account for public pension money dollar-for-dollar.,” says Caputo. “We should always be mindful of pay-to play abuse, more so when it comes to how pension contributions are treated. It’s simply responsible management of money well-earned by public employees to ensure their investment cannot be misused.”

The second piece of legislation would reduce, from $150 million to less than $75 million, the dollar amount of a casino’s full outstanding debt issue that would exempt a casino institutional investor from the requirement to maintain his or her good character or financial qualifications. Caputo and Ramos say by lowering the threshold for exemption, the state keeps investors honest in their dealings by requiring more of them to establish and maintain their qualifications for participation in the investment opportunity.

Ramos explains “This is hard-earned money earmarked for the future years of our public employees for which the state is responsible. It should not be left to any one person’s discretion on how it should be invested or contributed. We are legislatively protecting it to ensure it is there when it is needed.”

The final bill would cap at 35% the share of the State public employee pension and annuity funds portfolio that may be invested in alternative assets, such as hedge funds, private equity, commodities and real estate. Assemblymen Caputo and Ramos refer to the bill as “common sense” investing.

The Assembly Regulatory Oversight Committee advanced the measure today and it now goes to the desk of the Assembly Speaker for further consideration.

More From New Jersey 101.5 FM