![Corzine Says He Never Authorized “Misuse” Of Money [LIVE VIDEO]](http://townsquare.media/site/385/files/2011/12/135727435.jpg?w=980&q=75)

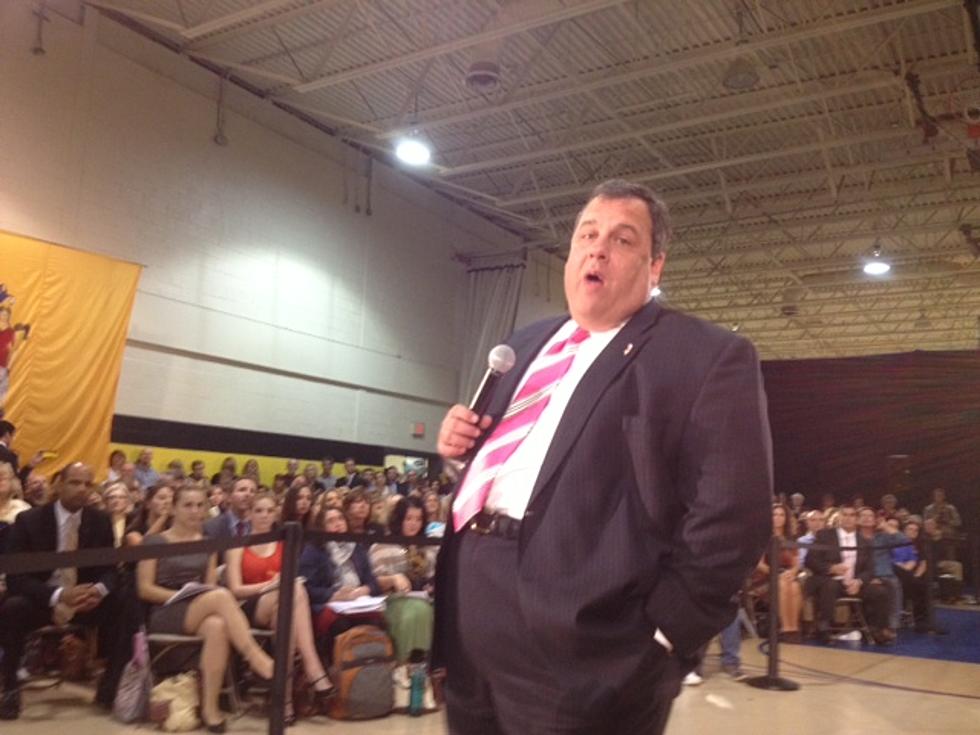

Corzine Says He Never Authorized “Misuse” Of Money [LIVE VIDEO]

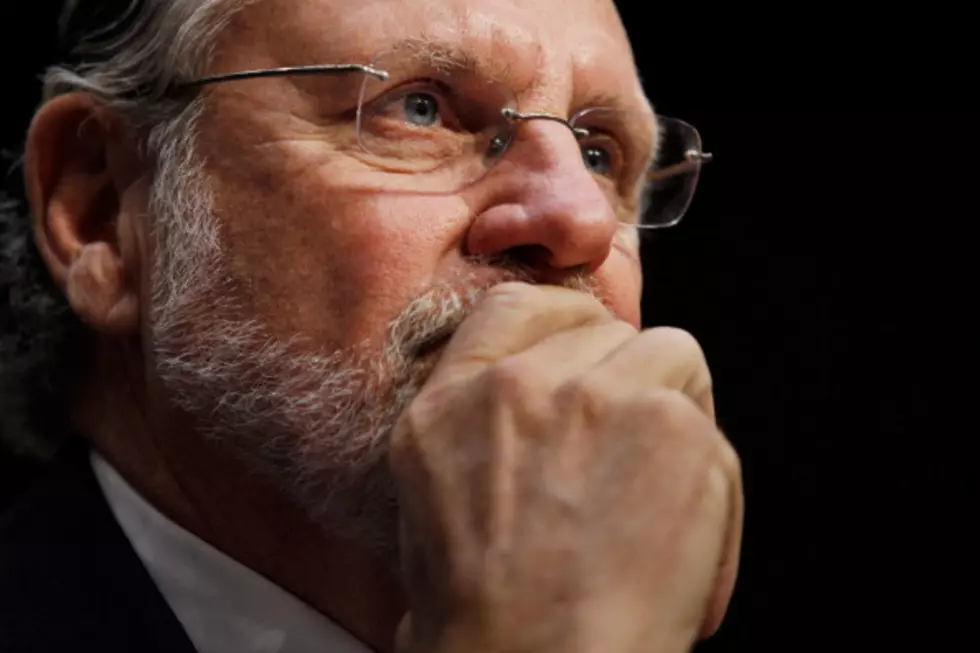

Jon Corzine has told a Senate panel that he never told anyone to "misuse" customer money that vanished when MF Global collapsed this fall.

An estimated $1.2 billion in client funds are missing. Senators are demanding Corzine and two other executives at the securities firm explain who authorized the transfer of money in the days before the firm collapsed in the eighth-largest bankruptcy in U.S. history.

"I never gave any instruction to anyone at MF Global to misuse customer funds," Corzine testified at a hearing of the Senate Agriculture Committee on Tuesday.

Corzine, a former Democratic New Jersey senator and governor, resigned as CEO of the securities firm last month.

Bradley Abelow, the firm's president and chief operating officer, and Henri Steenkamp, the chief financial officer, also tried to distance themselves from any decision to transfer the money at the hearing.

Brokers are required to keep client money separate from company funds.

"Funds don't simply disappear. Someone took action, whether legal or illegal, to move that money. And the effect of that decision is being felt across the countryside," said Kansas Sen. Pat Roberts, the committee's top Republican. Roberts said MF Global violated "a sacred rule of the futures industry," keeping customer funds separate from the firm's -- and that it was the first time that had happened. "You don't break the glass in regards to segregated funds."

All three witnesses said that they don't know where the money is.

Yet their testimony varied in subtle ways. Corzine said he did not direct anyone to misuse the money. Abelow said he does not recall directing anyone to divert the money. Steenkamp said clearly that he did not "authorize, approve or know of any transfers of customer funds" out of their accounts."

Depending on the circumstances, transferring money from customers' accounts could violate securities laws and, in some cases, could amount to a crime. Federal authorities have begun criminal investigations. And regulators are looking into whether the firm broke securities rules.

MF Global collapsed into the eighth-largest bankruptcy in U.S. history after a disastrous bet on European debt.

The three executives say they that they didn't become aware of the shortfall until hours before the firm filed for bankruptcy protection on Oct. 31.

Tuesday's hearing included an added element of intrigue because Corzine, a former Democratic senator from New Jersey, was pressed by some senators he served with from 2000 through 2005.

The Senate panel is one of three congressional committees to have issued subpoenas to compel Corzine's testimony on the issue.

It marked the first time a former senator has been subpoenaed by his former peers in more than 100 years, according to the Senate historian's office.

Many lawmakers have heard from farmers, ranchers and small business owners in their states who are missing money that was deposited with the firm. Agricultural businesses use brokerage firms like MF Global to help reduce their risks in an industry vulnerable to swings in oil, corn and other commodity prices.

Corzine told lawmakers last week that he never intended to authorize the transfer of funds from customer accounts. If any subordinates moved clients' money in the belief that Corzine had authorized it, "it was a misunderstanding," he said.

Corzine, Steenkamp and Abelow have been sued in class-action complaints on behalf of MF Global shareholders. The lawsuits accuse the executives of making false and misleading statements about MF Global's financial strength and cash balances.

MF Global didn't list the European debt on its balance sheet for all to see. Instead, those holdings were shifted to the company's "off-balance sheet," deep in its financial statements. Some separate filings with regulators excluded the European debt entirely.

A lawyer for the trustee overseeing the liquidation of MF Global's brokerage operations said in court Friday that the trustee's staff has discovered some "suspicious" trades in MF Global customer accounts that were made in the last days before the firm failed. The lawyer didn't provide details.

(Copyright 2011 by The Associated Press. All Rights Reserved.)

More From New Jersey 101.5 FM