Christie slashes tax hikes, signs $34B budget

TRENTON (AP) — Republican New Jersey Gov. Chris Christie used his veto pen Friday to strip more than $1.6 billion from the 2016 budget approved by the Democratic-controlled Legislature and signed a roughly $34 billion budget into law.

Christie vetoed an income tax increase and corporate business tax. He also conditionally vetoed the Democrats' millionaires' tax, but asked the Legislature to approve an increase in the earned income tax credit, something the Legislature has also called for. Christie proposes raising the credit for the 500,000 in the state who receive it to 30 percent of federal levels, instead of 20 percent. Democrats proposed raising it to 25 percent.

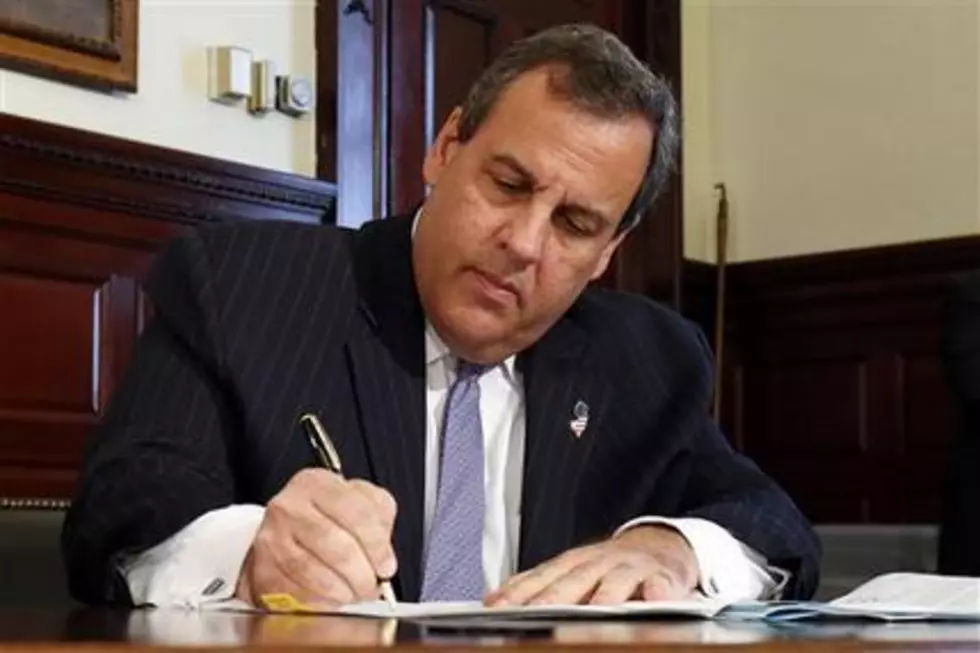

Christie signed the budget on Friday at the statehouse before a wide-ranging news conference.

"Once again the Legislature overspent," he said. "The action that I took on spending, discretionary spending — which means everything other than pensions, health care and debt service — is in this budget $2.3 billion less than it was eight years ago, which should show the people of our state that when we said we were gonna make government smaller that we in fact kept that promise and continue to do so."

The signature comes four days ahead of a deadline for enacting the budget on Tuesday — the same day he is expected to announce a run for the Republican nomination for president, according to several people familiar with his political plans. They spoke to The Associated Press on condition of anonymity because they were not authorized to pre-empt Christie's announcement.

Christie contrasted his budget action with other potential presidential primary opponents, specifically singling out Wisconsin, where Gov. Scott Walker could be a presidential contender.

"Today in New Jersey, four days early now that I've signed it, we have a budget. They don't have one in Wisconsin, with a Republican Legislature and a Republican governor."

Democrats, as expected, criticized Christie's vetoes and said his actions are digging a deeper fiscal crisis for the state. They said his increase in the earned income tax credit is the right thing to, but that he hurt families by vetoing it previously.

"Democrats submitted a plan to balance our budget and fully fund our obligations, but Governor Christie's fiscal policies continue without direction and review," said Democratic Assemblyman Gary Schaer.

The Democrat-led Legislature sent Christie a $35.3 billion budget on Thursday. Democrats had included a tax on income over $1 million, as well as a 15 percent surcharge on the corporate business tax to raise revenue and make the $3.1 billion payment to the state pension fund required by a 2011 law, which Christie had signed.

Christie's proposal slashed that amount to $1.3 billion after the state Supreme Court this month sided with Christie concluding the governor and Legislature must work out the payment through the budget process. He also said he is allocating an additional $212 million toward the pension because of unexpectedly high revenue collection late in the fiscal year.

The 2016 fiscal year budget advanced Thursday by a 24-16 vote in the Senate and by a 47-31 vote in the Assembly; the debate surrounding it fell along party lines. Republican lawmakers argued the budget would drive business out of the state and did not truly solve the state's pension funding problem. They called on Democrats to sit down with Christie to redraft a pension solution.

The budget doesn't address the state's transportation trust fund, which is headed for insolvency in the next fiscal year.

The budget's passage likely caps the Legislature's busy season as the Assembly, which is at the top of the ticket in November, looks ahead to the fall election and as Christie prepares his campaign plans.

Here's a look at the winners and losers of the budget:

WINNERS:

MILLIONAIRES: Christie spared residents with income over $1 million from a ratcheted-up tax rate under the Democrats' plan. Under their proposal, the income tax would rise from 8.97 percent to 10.75 percent on income topping $1 million, netting the state about $700 million in the coming fiscal year. Democrats envisioned the tax lasting four years. Republicans said it would kill small businesses and chase jobs out of New Jersey.

BUSINESSES: Christie sliced the 15 percent surcharge on New Jersey's corporation business tax out of the budget. Democrats expected their one-time levy to haul in more than $400 million for the state, but Christie called the proposal "ridiculous." From the floor of the Assembly, Republican Assemblyman Scott Rumana told the story of a local businessman who said he would be forced to close his shops that employed 150 people if the surcharge was enacted.

LOW-INCOME EARNERS: Christie called for increasing the percentage of the state's earned income tax credit, which traditionally helps lower-income families, from 20 percent to 30 percent of the federal credit. Democrats had proposed raising it to 25 percent in a bill sent to Christie, but he conditionally vetoed it Friday to increase the amount. The income threshold for 2014 for married couples or those joined in a civil union was $20,000. The Legislature must still weigh in on the conditional veto.

LOSERS:

PUBLIC-SECTOR UNIONS: The New Jersey Education Association, Communication Workers of America and other labor organizations representing some 800,000 people lost when the state Supreme Court ruled Christie did not have to abide by the 2011 law requiring escalating pension payments over seven years. The 2016 payment would have been $3.1 billion, and the Democrats' budget raised taxes in order to fund the payment. But Christie reduced it to $1.3 billion. He's called for 401(k)-style plans and other changes. Democrats say he breached the public's trust by going back on the 2011 law.

SCHOOLS: For another year, funding for schools is below what the School Funding Reform Act called for, this time by about $1 billion. Republicans argue that the money was never included in previous budgets because of financial constraints so it doesn't make sense to say, as some Democrats do, that the 2016 budget slashed school funds.

TRANSPORTATION: Christie correctly pointed out that his budget allocates millions of dollars for transit and transportation in the state. But Transportation Commissioner Jamie Fox warned legislators that the state's transportation trust fund, which pays for capital improvements, will reach insolvency by the end of June 2016. The budget doesn't address this concern. The fund is paid for by a constitutionally dedicated gas tax.

(Copyright 2015 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.)

More From New Jersey 101.5 FM