5 topics for Christie to address on Monday night’s ‘Ask The Governor’

Monday night, Gov. Chris Christie returns to the New Jersey 101.5 studios with a lot to talk about.

The “Ask The Governor” program returns for the first time since December, after a campaign-induced hiatus. Between a glance back at Christie’s White House run and a long litany of issues facing New Jersey, it should make for a likely hour of conversation.

Among the biggest topics that could be raised by host Eric Scott and callers …

The presidential race: Christie hasn’t said much publicly about his presidential campaign since it ended following his sixth-place finish in the primary in New Hampshire, where he had staked much of his time and money. For that matter, he hasn’t kept much of a public schedule since his return — though burst back onto the scene in a big way Friday, endorsing businessman and Republican front-runner Donald Trump for president.

A week after the Feb. 9 primary, Christie delivered his annual budget speech to the Legislature. In it, he thanked New Jersey residents “for allowing me the great privilege of running for president.”

“While the result was not what I had hoped for — maybe some of you, too — the experience has made me a better governor, it's made me a better American, and it's made me a better person,” Christie said. “All that growth, all that improvement, I owe to the people of New Jersey, and I intend to use it to make the next two years two great years for the state that we all love.”

Eight days after that, Christie attended a ceremony for the reopening of a Newark school that replaces a building that had been damaged by lightning and fire in 2006. The state spent $46.7 million to build the new Elliott Street Elementary School. Christie spoke, then left before the ceremony ended and didn’t interact with reporters.

Then, suddenly, Christie popped up Friday afternoon in Texas, where he endorsed Trump. During the waning days of his campaign, Christie — after memorably dismantling U.S. Sen. Marco Rubio in a debate — had said he would go after Trump more aggressively at a time of his choosing. That time never came. And now an endorsement has.

What motivated Christie's endorsement? Has he heard the criticism that he's being an opportunist? Does he think he might be vice president or attorney general? Does he expect to do much political travel later this year, as a surrogate for Trump or perhaps to support candidates in other states for Congress or governor?

And last but not least: Does he think he might run for president again in the future?

“Ask The Governor” is hosted by Eric Scott. Tune in at 7 p.m. or come to NJ1015.com and watch the program live.

The governor will be taking your calls at 800-283-1015 — but the phone lines fill up quickly. More ways to to get your question heard:

• Join in our live chat at NJ1015.com — The chat will open up at 6:30 p.m.

• Tweet your questions to @NJ1015 using the hashtag #AskGov during or ahead of the show. Selected Tweets will be featured on NJ1015.com as well.

• Ahead of the program, leave your questions in the comments section below.

Taxes: Christie’s budget speech earlier this month didn’t include a proposal for the future of the state’s Transportation Trust Fund. He reiterated that there’s not a crisis for the TTF, which is funded through the end of the current fiscal year but not beyond. That’s 122 more days.

Lawmakers say they’re a little fuzzy on what Christie is willing to accept in a TTF financing plan. Many contend that a hike in the gas tax will be needed to help pay for part of it, and Christie has said that all options are on the table for consideration.

But legislators aren’t sure how much to read into this comment Christie made about four weeks ago while campaigning in New Hampshire: “I'll tell you what I'm not going to do, I'm not going to increase the gas tax while you're sitting here and complaining to me about every other tax being too high.”

Christie has called for a cut in the state’s estate tax, perhaps in the interest of “tax fairness” in conjunction with the hike in the gas tax. The estate tax is applied when a person dies with an estate worth more than $675,000, amounting to roughly 4 percent of deaths in New Jersey.

Lawmakers seem to be on board with cutting the estate tax – though not the "death tax" companion that is the inheritance tax, which is levied on some people who are bequeathed money or assets from a person who dies. It appears Christie wants to end the estate tax specifically, not both taxes.

Atlantic City: Five weeks ago, Christie was joined by Atlantic City Mayor Don Guardian and Senate President Stephen Sweeney for an announcement at the Statehouse about the next steps in the effort to stabilize Atlantic City’s municipal finances – primarily through legislation that would give the state sweeping authority over local decision making and spending for five years. Some called it a takeover, others an intervention or even a partnership.

By the time the bill itself was made public, Guardian had a new name for it: “Fascist dictatorship.”

It’s unclear whether opposition for Guardian and other Atlantic City officials would matter much, as it appears Christie still supports Sweeney’s approach despite protests from the city’s Republican mayor. One thing is clear: The Legislature isn’t meeting Christie’s call for the bill to be passed by the end of February.

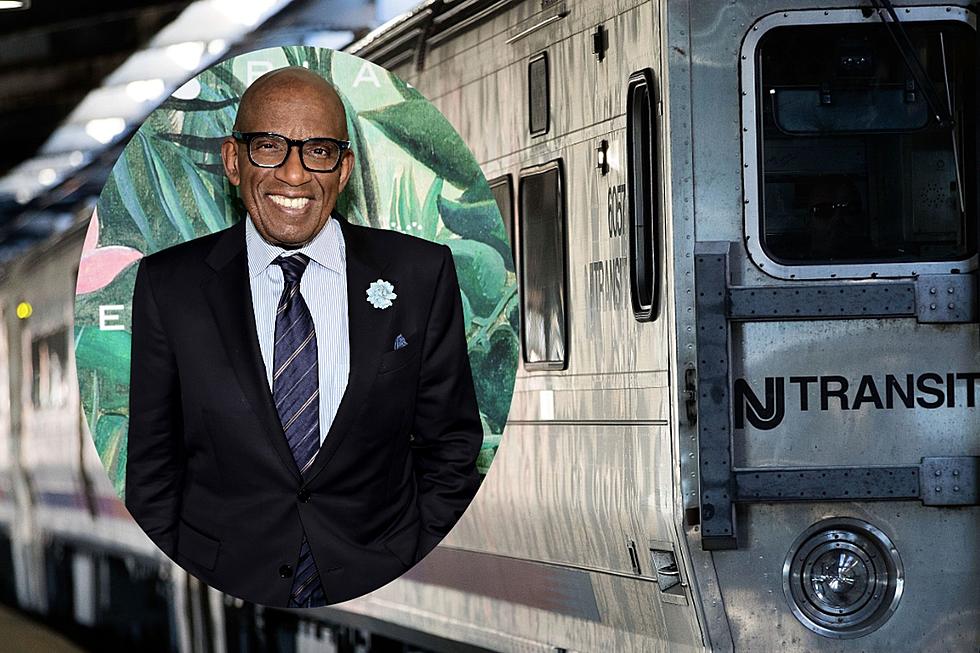

New Jersey Transit strike? Train commuters in New Jersey face the possibility of major problems in just 13 days, when rail unions representing 4,200 members who’ve been working without a contract since 2011 could go on strike or be locked out by management.

Contract talks are hung up over health insurance costs. Two federal labor boards have endorsed union-sponsored proposals calling for workers to contribute up to 2.5 percent toward their health insurance. NJ Transit says that would trigger large fare hikes and want workers to pay up to 20 percent.

A cooling-off period during which strikes and lockouts are forbidden expires March 13.

If the rails are shuttered, it’s likely that commuters would be steered to buses, though NJT hasn’t released its contingency plan.

Hospital tax status: Among the pressing issues on which hospitals, municipalities and lawmakers are clamoring for resolution is the property-tax status of nonprofit hospitals that contain for-profit medical providers.

Last June, a Tax Court judge ruled that Morristown Medical Center operates as a for-profit entity and that tax exemptions for much of its property could be revoked. It was found liable for back taxes, and the hospitals wound up settling the case for $15.5 million, plus $1.05 million a year going forward. Now, a dozen more municipalities are challenging the tax status of local hospitals.

Christie used his pocket-veto authority at the end of the last legislative session in mid-January to reject legislation that would have had nonprofit hospitals pay ‘community service contributions’ to their host municipalities, rather than be subject to property taxes. The association representing cities and towns urged Christie to reject the bill, believing that the payments would have been too low.

That bill was among more than 60 that Christie pocket vetoed, a process that doesn’t require an explanation for the bill’s rejection. Among the others turned down: an Ocean County pilot program for electronic monitoring of domestic violence offenders, requiring recess in grades K-to-5, directing gun retailers to sell personalized ‘smart guns’ alongside traditional guns and raising the smoking age to 21.

More From New Jersey 101.5 FM